Stock

commercial

- EXCHANGE

- GOLD RATIO

Sugary drinks may get unsavoury tax

12:00 | 25/08/2017

The Ministry of Finance is proposing the levy of a special consumption tax of 10-20 per cent on sugary drinks to combat obesity rates, though a similar proposal was rejected by the government three years ago. VIR’s Van Thu offers insight into the hot debate surrounding the new proposal.

|

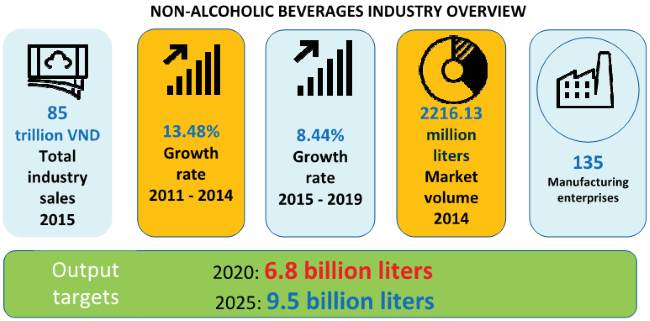

| Source: The Ministry of Industry and Trade – The development plan of the beer, alcohol, soft drinks of Vietnam to 2025 and vision to 2035 |

As the mother of an obese 10-year-old boy from Hanoi, Nguyen Huong Lan has to do battle with retailers, friends, family, and nursery workers to police her son’s intake of sugary drinks.

“I have become the sugar police, the woman who nags the nursery, all because I want my son to keep fit – he’s already hit 50 kilogrammes, the same weight as me. I’m concerned. Even the term obesity is scary to me,” Lan said.

It is not a rare case, as childhood obesity is a new and emerging problem in Vietnam. And now, Vietnamese tax authorities are citing this problem as grounds for their new proposal for a special consumption tax (SCT) on sugary drinks.

Stopping the sugar high

Last week, the Ministry of Finance (MoF) – the compiling body of the revised draft on the SCT – introduced the draft amendments to tax laws for public comments: one with a tax rate of 10 per cent, and the other with a tax rate of 20 per cent. Both would take effect in 2019.

If approved, the proposal would see the tax imposed on carbonated and non-carbonated soft drinks, energy drinks, sports drinks, and bottled instant coffee and tea. It is widening the list of items subject to the SCT to “direct the consumer trend”, given their harmful effects. The MoF’s proposal of three years ago set the SCT at 10 per cent on only carbonated drinks.

“The imposition of the tax aims to regulate the consumption of sugar-based beverages according to international practice,” explained Pham Dinh Thi, director of MoF’s Tax Policy Department.

The ministry also pointed to a World Health Organization (WHO) report that shows that the abuse of soft drinks leads to obesity. The proportion of overweight and obese adults in Vietnam now stands at 25 per cent of the population. Obesity rates among children under five years old are also increasing rapidly, and this puts them at future risk from cardiovascular disease, hypertension, stroke, atherosclerosis, and other ailments.

MoF seeks to follow the practice of many countries by imposing excise taxes to limit the consumption of sugar-based drinks. In Thailand, for example, non-alcoholic carbonated soft drinks are subject to a tax rate of between 20 and 25 per cent. Laos imposes 5 to 10 per cent tax on soft drinks, and Cambodia 10 per cent.

Thi quoted experts as saying this tax will hike the prices of unhealthy drinks and reduce the number of people who consume large quantities of them. Sugar-sweetened drinks are known to be a contributor to obesity, particularly in children and young people.

With a forecasted annual growth rate of 6 per cent to 2020, the beverage industry in Vietnam is one of the fastest growing consumer goods segments. According to Canadean, a world-class research company focusing on international soft drink and alcoholic beverage industries, growth in Vietnam’s alcoholic beverage market has averaged 6.4 per cent per year over the last decade, and 5.7 per cent over the last five years.

Well-known investors such as Coca-Cola, PepsiCo, Nestlé, URC, and Tan Hiep Phat have also increased their share in Vietnam or conducted merger-and-acquisition activities with local firms to bolster their market share.

Battling mixed opinions

The MoF’s proposal, however, has encountered protests from business associations and companies saying it is not justified.

Adam Sitkoff, executive director of American Chamber of Commerce (AmCham) in Hanoi told VIR, “Our members do have concerns about MoF’s proposed tax rates and manner of beverage taxation. The proposed 10 per cent excise tax would double the rate of taxation of this category of products.

“AmCham recognises the need for the Vietnamese government to collect revenue, and we support tax regimes that are fair and don’t discriminate against certain industries or groups of taxpayers. I believe that this suggested tax increase and subsequent rates could halt growth and investment in this business sector.

“The sudden introduction of excise taxes at the suggested levels would require manufacturers to raise prices accordingly, which hurts the spending power of Vietnamese consumers.”

Nestlé Vietnam’s statement to VIR reads, “We have reservations about selective taxes on food and beverage products, as there is currently no clear evidence that they are effective in combating obesity. We see them as a narrow tool to address these critical public health concerns.”

Nestlé’s statement also pointed out that as part its global Commitment on Nutrition, Health and Wellness, “we have group-wide policies to proactively reduce sugar across our relevant product categories, through ongoing product reformulation”. Nestle confirmed that the company shares the concern of governments and health authorities on obesity and related non-communicable diseases.

Coca-Cola stated that it does not oppose taxation, and that the company has consistently paid all taxes according to local laws. But it stressed, “Coca-Cola opposes efforts that isolate non-alcoholic beverages for additional, discriminatory taxes. Such discriminatory taxes conflict with the best practices in international fiscal policy, of broad-based taxes with low rates and few exceptions.”

Jonathan L. Moreno, chairman of AmCham in Ho Chi Minh City, warned that if such proposals are made law, there could be unintended consequences. These taxes could prompt consumers to substitute carbonated soft drinks with other non-taxed products with some of the same attributes, and be a poor message for potential investors to Vietnam.

He said, “As a general rule, we oppose taxation which might be considered to be discriminatory. The challenge with taxation focusing on a specific product category with the purpose of protecting health is that other categories which might have similar or worse health consequences are not subjected to the same market limiting factors. Therefore, broad based and measured tax approaches seem to be a more prudent approach.”

Seeking a root cause

“Obesity is complex and isn’t caused by one unique factor. Telling people that eliminating one product from their diet is a silver bullet solution to certain health issues such as obesity is misleading,” said AmCham’s Sitkoff.

He raised the question of whether concerns over unhealthy foods and drinks will spread. “Will MoF apply this tax to bun cha (noodles with grilled pork), che (sweetened bean soup), and fried nem (spring rolls)?” he asked.

“I strongly support efforts to improve the health and well-being of people. I even try to eat a well-balanced diet myself. However, being healthy is a combination of many things, including lifestyle. Sugar has been around for more than 2,000 years, and consumers want to be able to choose products they enjoy.”

Lan, mother of the obese 10 year-old, said, “The tax might change people’s behaviour, but it is not enough. Taxes do not teach healthy lifestyles; if we want a healthier country, we need better education about exercise and balanced diets.”

VIR