Stock

commercial

- EXCHANGE

- GOLD RATIO

Is it a good time for Vietnam to raise value added tax?

12:00 | 28/08/2017

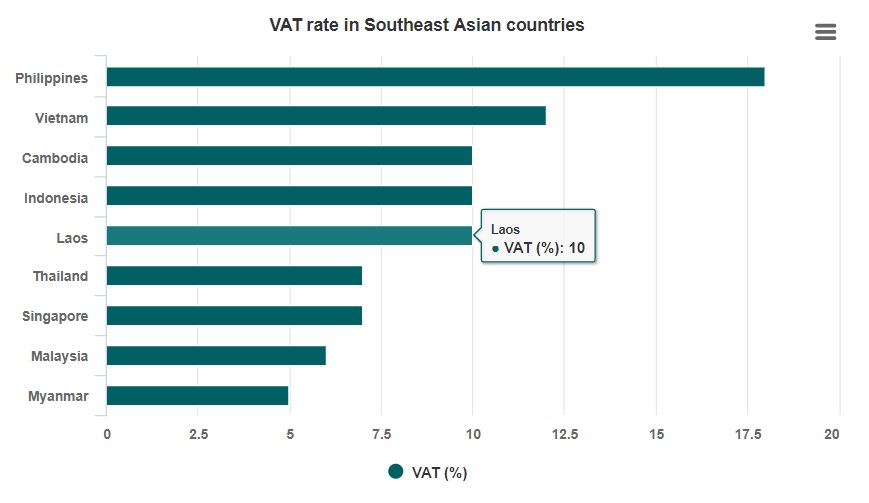

If the proposal is approved, Vietnam's VAT rate will be the second highest in Southeast Asia.

Vietnam's Minisitry of Finance is looking to raise value added tax (VAT) from the current base level of 10 percent to 12 percent, starting from 2019.

If the proposal is approved, Vietnam will have the second highest VAT rate in Southeast Asia, only after the Philippines, where goods and services are levied at 18 percent.

The proposed 2-percent tax hike has triggered a heated debate among economists, policymakers and businesses.

The ministry insists that raising indirect taxes (such as VAT) is essential and an international norm. “It is the global trend that can be seen in many developed nations such as the United States and European countries,” said a ministry official.

The added tax will make up for when Vietnam fulfils its commitment to cut import tariffs under free trade agreements, and help tackle rising public debt, according to authorities.

The World Bank has forecast that Vietnam’s public debt will climb to 64.4 percent in 2017 and 64.7 percent in 2018.

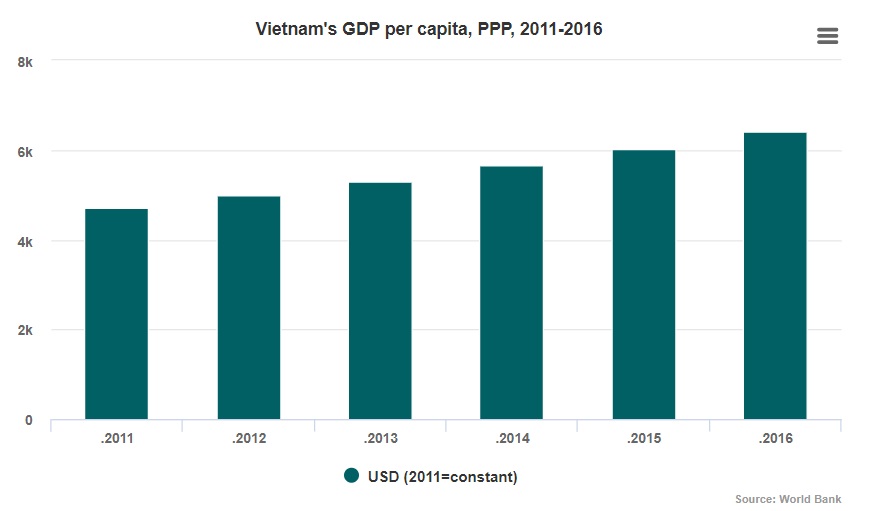

But some experts and analysts believe that the increase will have a negative impact on consumption considering the slow improvement in purchasing power witnessed in recent years.

Ngo Tri Long, a seasoned economist, is strongly opposed to the idea, claiming that taxation was a tool for economic growth, but using tax as a sole instrument to balance the state budget is impossible.

"Given the sluggish global economy, is raising VAT a wise idea?" Long questioned.

"We should carefully calculate all the impacts. Any sort of tax increase must be based on economic reality, instead of stiff economic logic. Tax hike at this time may slam the ministry’s purpose," he added

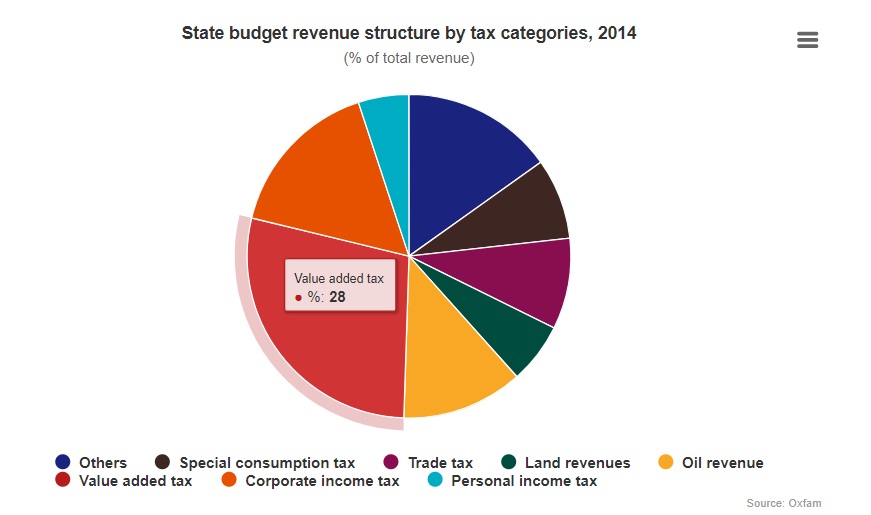

Over a quarter of the total Vietnam government’s revenue was generated from this notoriously so-called regressive tax – VAT, according official data from Oxfam.

According to the Ho Chi Minh City Securities Corporation, the tax hike will contribute VND59 trillion ($2.6 billion) per year, making up 33 percent of the country's total revenue. Analysts believe that this proportion is "way too high", given that the average contribution of VAT in OECD countries stands at just 21.4 percent.

VAT is inclusive so the poor and the rich contribute the same amount to the budget and the burden is placed on those who have less ability to pay.

World Bank data show that income inequality in Vietnam has increased in the last two decades, and the richest are taking a disproportionate share of income.

"Indirect taxation is a disproportionate burden on lower-income households, which spend a much higher proportion of their budgets on goods which are subject to excise duties than more affluent ones," Vu Thanh Tu Anh, an economist with the Fulbright University in Ho Chi Minh City, added. "Yet, equality between taxpayers can’t be achieved."

The current tax law also imposes a preferential 5 percent VAT on certain goods used in agriculture, medicine, education and science and technology; however the ministry’s proposal would also bump this figure up to 6 percent.

A source told VnExpress International that hiking indirect taxes is a global trend but it should be noted that besides VAT, the special consumption tax is also an indirect tax and the government should consider imposing a higher tax rate on some harmful products such as tobacco, rather than targeting VAT.

In response to VnExpress International's questions about tax policies in Vietnam, Sebastian Eckardt, a senior economist at the World Bank, said that the government should quantify and calculate carefully to fully assess the impacts of the indirect tax hikes on the economy as well as people’s lives.

He also urged the government to consider imposing a higher special consumption tax on tobacco and alcohol given the low rates in Vietnam.

Beyond the VAT increase, the Ministry of Finance has also announced a proposal to double the special consumption tax on pickup trucks from 15 percent to 30 percent, depending on the vehicle model.

Soft drinks are also expected to come with a 10 percent tax by 2019, while packs of 20 cigarettes will have a staggering 75 percent slapped on that same year.

e.vnexpress