Stock

commercial

- EXCHANGE

- GOLD RATIO

Mobile World hitting the brakes?

12:00 | 05/10/2017

When it is impossible to break through market saturation and escape the downward spiral of stagnant growth, founders of local retail businesses often decide to sell their enterprises to find other opportunities. Is this also true for Mobile World Group?

Tran Anh takeover

Over the weekend, new information has been revealed on the M&A deal between Tran Anh Digital World JSC (TAG) and Mobile World Investment Corporation (MWG), providing a glimpse into the staff reorganisation process.

Specifically, the Board of Directors of Tran Anh has signed the decision to appoint Vu Dang Linh as chief financial officer from October 1, 2017 to September 30, 2018 or until another decision is made. Linh has been the CFO of Mobile World since 2013.

Accordingly, Linh was authorised to sign loan contracts on behalf of Tran Anh as well as manage revenues and expenditures, except for loan contracts which are required to be signed by Tran Anh’s representatives. At the same time, Linh will carry out other management activities as Tran Anh’s CFO and account holder.

Apart from assigning Vu Dang Linh to control the firm’s corporate finances, TAG also appointed Vo Ha Trung Tin as its new deputy general director. Tin will be in charge of signing transaction deals and agreements between Tran Anh and third parties to support the business and operations of Tran Anh’s system.

Ha Trung Tin is also one of the senior leaders of Mobile World and is currently director of the Dien may XANH chain in the northern region.

It is considered Mobile World’s first step in taking over this business after Tran Anh’s shareholders approved selling the company to Mobile World.

According to Tran Kinh Doanh, general director of Mobile World, the deal is entering its final stage. Details of the acquisition will be announced by the two sides in this October.

Rumours of Mobile World “selling itself”

The intention of Mobile World to buy Tran Anh to reinforce its market position, as well as to grab higher market share for the Dien may Xanh chain in the north is not surprising for investors and retailers.

Instead, this is even good news for both parties. The systems of Tran Anh and Dien may Xanh will complement one another for quick shortcuts to gain market share. Accordingly, the two sides will serve two different customer groups. Specifically, Dien may Xanh stores will serve as mini-supermarkets, while Tran Anh stores will be operated in the form of electronic hypermarkets.

However, as part of the recent information that startled many, businesses in the Vietnamese retail and distribution sector have speculated that, along with the implementation of some M&A deals with partners in the electronics and pharmaceutical industries, Mobile World is about to “sell itself” to foreign partners. The strong media moves in the past were meant to serve the sale.

Moreover, rumours also said that all Mobile World founders had decided to retire early and leave the playing field for the next generation.

“A host of domestic and foreign brands must rely on M&A deals to save themselves. This has shown, in part, in the increasingly competitive market. More importantly, this has depressed the winning spirit of many entrepreneurs,” said a director of a retail chain in Hanoi.

|

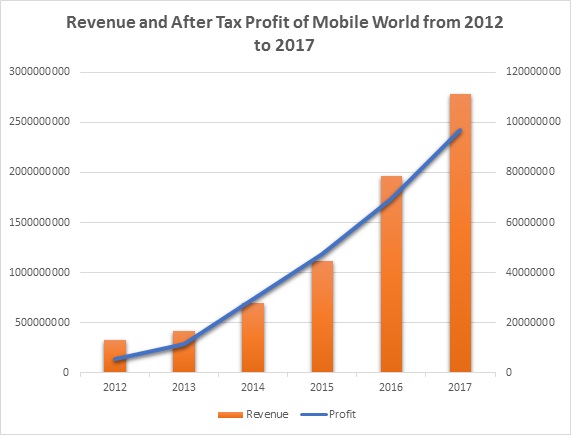

| Mobile World’s estimated revenue and after-tax profit from 2012 to date (Unit: million USD) |

Mobile World’s chain of mobile phone stores is showing signs of saturation. Although these stores still contribute the largest portion of Mobile World’s revenue, the overall growth rate of the chain is slowing down.

The rumour is rational to some extent, as the latest report on the retail market of Savills Vietnam reveals that the big foreign retailers’ appetite for M&A deals is constantly increasing.

It is not that Vietnamese businesses do not want to continue to develop and expand scales sustainably. Yet, greater scales means greater possibility to spiral out of control.

This seems to be true as Mobile World is finding ways to produce growth in an increasingly saturated technology and mobile phone retail market. This year, Mobile World sets a target of nearly $3 billion in revenue and aims to reach $10 billion by 2020. The mission is not easy, especially as Mobile World’ key store chains are decelerating.

Since late 2016, Mobile World’s pace of expansion reduced to 10-20 stores per month, instead of opening “two stores every day” as it did before. In the past few months only a handful of stores opened. Therefore, Mobile World’s revenue keeps hovering at VND2.7 trillion a month ($118.94 million). They can hardly surpass the VND3 trillion-mark ($132.16), only in the months around the Tetholiday, when the consumption demand is the highest.

According to the analysis of Ho Chi Minh City Securities Company (HSC), the mobile phone chain of Mobile World has shown signs of saturation. Its market share remained unchanged at 42 per cent, while it used to rise by 1-2 per cent in each quarter.

The reason, according to HSC, is that the company has had most of the prime locations with good customer flows across Vietnam. The store-opening rate is higher than the general growth rate of the whole market, which forces Mobile World’s stores to compete with each other, leading to the unchanged market share.

Regarding Dien may Xanh outlets, Mobile World has managed to follow the planned pace of expansion and the average revenue growth per store is also close to the expected 12 per cent target compared to the same period last year.

However, the driving force for growth mainly comes from chain development in tier-2 cities and regaining market share from small retailers. Meanwhile, in some important markets in the north, the company is struggling with strong competition from rival chains. As a result, the Dien may Xanh chain appears to be a catalyst for the company’s growth. .

In just the first eight months of this year, Mobile World opened 414 new stores across the country. Of these, only 90 are Thegioididong.com stores, besides 219 Dien may Xanh stores and 105 stores of the Bach hoa Xanh chain.

As of the end of August 2017, Mobile World had 1,669 stores. The Thegioididong.com chain had 1,041, Dien may Xanh 475, and Bach hoa Xanh 153.

In addition, after Mobile World asked shareholders to raise the budget for M&A deals to VND2.5 trillion ($110.13 million) this year, five times higher than the previously approved figure. This amount seems to go for two goals.

In addition to the acquisition of Tran Anh, Mobile World is looking for M&A opportunities with pharmaceutical businesses. This field still has abundant room to be exploited and developed. Particularly, the targets for M&A deals in this area have been clearly identified and if these deals go smoothly, Mobile World can upgrade its chain of pharmacies to 500-800 stores.

However, Doanh said that there is no such thing as Mobile World selling itself. “We are more likely to buy others,” Doanh said.

At this point, the question of who can afford to acquire Mobile World is still open and they are still on the way to become a “giant” in the Vietnamese retail market.

Anh Hoa

VIR